Petty cash is a shop of money this is effortlessly accessible, i.e., withinside the shape of cash, that agencies and different companies preserve for expenditure on miscellaneous and small objects. It is a discretionary cash fund for bills wherein bank transfers or writing a test (British: cheque) might now no longer be the satisfactory or maximum realistic option.

It is likewise the overall ledger name wherein accountants or bookkeepers input the quantity of a organization’s petty cash.

How lots is withinside the fund varies appreciably. Small companies would possibly have just $50 at the same time as large ones can also additionally have up to $500, or maybe more.

Shopify.com has the following definition of the term:

“Petty cash is a small quantity of real cash that a organization has handy to buy objects that price so little that slicing a test doesn’t make experience or isn’t realistic.”

“It is frequently used to reimburse personnel for quite low-cost purchases, together with a birthday cake for an worker or breakfast treats for the morning workforce meeting.”

Examples of petty cash payments

A organization can also additionally use this fund for the subsequent costs:

- Office supplies.

- Delivery charges.

- Travel expenses.

- Coffee, sugar, milk, biscuits, and different worker snacks.

- Franking, Notary charges, stamps, and small bank charges.

- Gifts for customers or unique clients.

- Soap, lavatory paper, and cleansing products.

- Van or truck wash.

- Vehicle fuel.

- Casual labor.

- Flowers.

- Cards.

- Miscellaneous expenses.

In accounting, miscellaneous refers to small, rare transactions.

Custodian

Upper control or any individual in accounting generally appoints someone to be accountable for the fund. We call that character the petty cash custodian, petty cashier, or honestly custodian.

They ought to make certain that everyone adheres to the fund’s guidelines and regulations, request top-ups (replenishments), and pay for things (dispense funds).

Do now no longer provide all personnel get right of entry to to the fund. If you do, the occurrence terrible report-maintaining or maybe robbery may be appreciably greater.

Courses.LumenLearning.com says the following regarding the custodian and the use of vouchers:

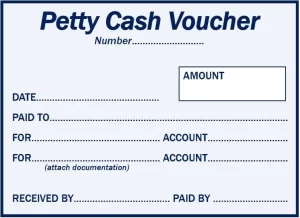

“When disbursing cash from the fund, the petty cash custodian prepares a petty cash voucher, which need to be signed with the aid of using the character receiving the funds.”

“A petty cash voucher is a file or form that suggests the quantity of and cause for a petty coins disbursement.”

Keeping petty cash transaction records

It is important that each one bills and top-up monies are recorded. Make positive there’s a petty cash slip or voucher for every transaction. When you report a payment, consist of the date and an outline of that expenditure (what you used the money for).

Your statistics ought to specify how and why bills have been made. It is likewise important that each one prices are business/work related.

According to Billomat, which created and sells a cloud-based accounting software program:

“The distinction with cash bills made with the aid of using clients need to tally with the entire petty cash costs from the drawer.”

“As your workplace fund drawer receives beneath the pre-set quantity, you want to decide the upload to the drawer with the aid of using having a test to cash in with the phrases “Petty Cash.’”

Etymology of petty cash

Etymology is the have a look at of the foundation of phrases and the way their meanings have advanced over time.

The word ‘Petty’ first appeared in the English language withinside the past due fourteenth century. At that time, it meant ‘Small.’ It got here from the Old French word ‘Petit,’ which meant ‘Small.’ It wasn’t till approximately one hundred years later that it started to even have a disparaging meaning (because it does nowadays withinside the phrase “don’t be petty,”).

The first written report of ‘Petty Cash’ with its current meaning, that we recognise of, changed into dated 1834.