They say you ought to in no way rely your glasses of wine. But you ought to virtually rely an IPO’s gray marketplace top rate (GMP). Nashik-primarily based totally Sula Vineyards is presently commanding a GMP of Rs 30 in line with percentage, stated marketplace watchers, indicating wholesome retail pleasure for the imminent public difficulty.

India’s biggest wine maker, Sula has set the charge band for its preliminary public offering (IPO) at Rs 340-357 a percentage. The difficulty will open for subscription on December 12 and near on December 14. At the higher give up of the charge band, the problem length involves Rs 960.34 crore.

“At the present day GMP, retail traders can count on a list benefit of about 9-10 percentage,” stated Mehul Bumtaria, an energetic player withinside the IPO marketplace.

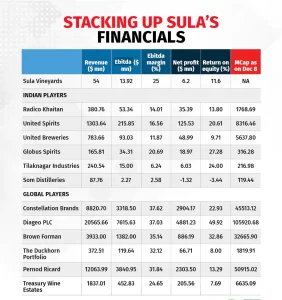

A purpose in the back of this pleasure can be Sula Vineyards’ relative valuation cut price to its friends. According to the draft crimson herring prospectus, the organisation’s income in line with percentage (EPS) stood at Rs 6.seventy nine as on March 31, 2022. So on the higher give up of the charge band, the charge-to-income (P/E) ratio is fifty two.five instances FY22 income. Meanwhile, its friends Radico Khaitan, United Spirits and United Breweries are buying and selling at TTM (trailing twelve months) P/E of fifty five.sixteen, eighty and 127 instances, respectively.

Sula’s financials

As of September region give up, Sula Vineyards had awesome borrowings of Rs 231.five crore and coins and coins equivalents of Rs thirteen crore.

Over the remaining 5 years, Sula’s economic overall performance has been inconsistent. For the yr ended March 2018, it stated internet income of Rs 12.three crore. Next yr, internet income become Rs 7.2 crore accompanied with the aid of using a lack of Rs sixteen crore. For the yr ended March 2021, which become the COVID-affected yr, internet income become Rs three crore. And the yr after that, proper earlier than the IPO, internet income jumped to Rs fifty two crore.

Sales have additionally grown unevenly over the identical period, growing from Rs 433 crore to Rs 557 crore, then falling to Rs 531 crore, and in addition to Rs 421 crore earlier than choosing up a piece to Rs 456 crore.

So, is the contrast with friends fair?

According to commercial enterprise studies organization Technopak estimates, the wine class in India become at 2 million instances in FY21 and is projected to develop to three.four million instances with the aid of using FY25. But this is best a small drop withinside the alco-beverage ocean.

Currently, the whole alco-beverage intake marketplace in India stands at 987 million instances. Of this, 30 percentage is beer, 69.three percentage spirits and best 0.7 percentage is wine. Going with the aid of using Technopak’s projections for 2025, the whole marketplace will develop to 1.23 billion instances. Of this, 450 million instances can be beer, 781 million instances can be spirits and approximately four million can be wine. That remains pretty much 0.five percentage of the marketplace.

For the wine enterprise, a compound annual boom charge (CAGR) of 14 percentage among FY21 and FY25 may appear far-fetched, trust enterprise experts, because the enterprise grew at best 6 percentage CAGR withinside the pre-COVID era, among 2010 and 2019.

“The organisation may boast a fifty two percentage marketplace percentage with the aid of using fee withinside the wine section however we’re speaking approximately converting purchaser choice over right here to extend the marketplace in addition. Why might a man from tier-2 or tier-three metropolis purchase a bottle of wine, once they should buy correct IMFL manufacturers on the identical charge?” requested a portfolio control provider fund supervisor who holds Radico Khaitan in his portfolio.

IMFL stands for Indian-made overseas liquor.

Apart from IMFL, IMIL or Indian-made Indian liquor has additionally been gaining floor withinside the usa. Of the whole spirits marketplace in India, IMIL presently holds greater than 50 percentage percentage. IMIL or ‘usa liquor’ consists of manufacturers like Santra, Nimboo, Ghoomar and Heer Ranjha.

Globus Spirits, a producer of IMIL that has a better go back on fairness than Sula Vineyards, is to be had at a less expensive valuation of 18.forty five instances FY22 income. So is GM Breweries at 11.34 instances.

Sula Vineyards’ commercial enterprise version of wine income and wine tourism is greater just like that of world friends like Duckhorn Portfolio and Treasury Wine Estates. Duckhorn Portfolio, recognised for its wine estates in Napa Valley, California, trades at a P/E of 29.6 instances FY22 income.

Other indexed worldwide alcohol shares also are buying and selling at valuations less expensive than Sula’s.

Back home, wine pioneer Indage Vintners delisted in 2011 after debt and coins problems. The inventory that had as soon as touched a excessive of Rs 974 in 2007 ended its run at round Rs thirteen. But to be fair, Sula is the maximum credible wine manufacturer from India.

Key risks

“Growth triggers are truly there. It is presently a ‘winner takes all’ marketplace and Sula is the winner. Wine may be without problems bought in grocery shops and top rate retail formats. Tax factor withinside the MRP is likewise low as compared to spirits,” stated Karan Taurani, senior vp at Elara Capital.

But he too sees a trouble in scaling up the commercial enterprise. The pinnacle wine generating states, Maharashtra and Karnataka, also are the pinnacle ingesting states, accounting for near fifty seven percentage of the general marketplace in India.

“As Sula enters tier 2 and tier three cities, we can need to wait and watch to apprehend how more moderen markets are reacting to this class of liquor,” he added. In 2014, India’s in line with capita intake of wine become much less than 10 ml. Today, it’s far approximately 30 ml, in keeping with Technopak.

According to analysts, premiumisation can be a boom cause for Sula Vineyards, however right here, it faces the chance of opposition from overseas labels.

Currently, the import of wine and spirits in India draws obligation on the charge of a hundred and fifty percentage of the fee being imported. Thus, the wine marketplace in India has restricted global players.

“If the authorities reduces the import obligation on wine, we may also face multiplied opposition from global labels, which may also have better enchantment to customers in phrases of range and pricing,” the organisation stated in its crimson herring prospectus.

For instance, in April this yr, India entered right into a change settlement with Australia which, while in force, will provide a phased discount of import obligation over 10 years on positive Australian wines.

When it involves premiumisation, there’s additionally the notion and flavor struggle to be won. Optimal situations for developing grapes are commonly located among 30 and fifty five levels range on both facet of the equator. India, which lies withinside the northern hemisphere, does now no longer fall on this area.

“If it follows the northern hemisphere cycle, the grapes are too diluted due to the rains and moisture,” stated an enterprise professional on situation of anonymity. “That makes it appropriate for ingesting however now no longer for wine-making. If it follows the southern hemisphere cycle, the grapes prevent ripening by the point of harvest because of severe heat. So, Indian wines can’t be as compared to the top rate wines of Napa or Europe.”

Only provide for sale

The difficulty is a entire provide for sale (OFS) of as much as 26,900,530 fairness shares. “In complete OFS, the organisation does now no longer acquire any amount. Only the promoting shareholders will benefit. In a sparkling difficulty, budget might have been utilized by the organisation in increasing its commercial enterprise and for different fashionable company purposes,” stated Manan Doshi, co-founder, of unlistedarena.com, a pre-IPO-targeted platform.

That, say experts, ought to be a caution sign for capacity traders. The list is to useful resource current traders get an exit, in place of to fund any growth or maybe lessen its borrowings.

“I might alternatively purchase a bottle in their wine on the identical charge than put money into their inventory,” concluded the PMS fund supervisor quoted earlier.