In the term ‘mortgage rate’, the word ‘rate’ approach ‘interest’. A mortgage rate is the interest that we pay on a home loan. A loan is a domestic loan, i.e., a loan to buy a property.

The length of the month-to-month installments on a home loan relies upon on how plenty is borrowed in addition to the mortgage rate. In this context, the sector ‘installment’ approach month-to-month bills.

The better the mortgage rate is, the amazing the month-to-month installment will be.

Mortgage Rates: Short- & Long-Term Loans

Shorter-time period loans generally have decrease loan prices in comparison to 30-yr loans. However, shorter term loans, i.e., 15-year mortgages, have more month-to-month bills.

In the sector of mortgages, short-time period refers to a 15-year loan, whilst with a long-time period loan, the borrower will pay over 30 years.

First Foundation has the following definition of the term:

“Mortgage fee is the interest that a mortgage borrower will pay for money borrowed towards a loan.”

“When a purchaser borrows from a loan lender, the borrower can pay interest on the quantity borrowed, as a fee for using the borrowed cash.”

Fixed-Rate & Adjustable-Rate Mortgages

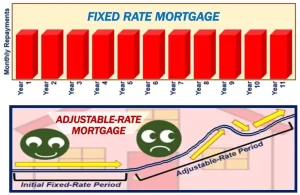

With a constant-fee loan, the mortgage rate stays unchanged all through the lifestyles of the loan. Some humans opt for this due to its predictability, which permits them to plot ahead.

With an adjustable-rate mortgage, on the alternative hand, the interest rate is handiest constant for the primary few years, and then it’d pass up or down.

Factors Influencing Mortgage Rates

You loan rate relies upon on things, the kingdom of the country wide economic system and your credit rating.

Benchmark Interest Rates

Your country’s central bank sets its benchmark interest rates, which impacts the interest rates on all forms of loans, consisting of mortgages.

Credit Score

Your credit score rating is likewise a factor. People with low credit score rankings generally have better mortgage rates than their opposite numbers with excessive rankings.

Down Payment – Deposit

If you need to decrease the mortgage rate to your loan, ask your bank whether or not paying a larger down payment at the house you intend to shop for may help.

Some lenders see mortgages with massive down bills as decrease hazard loans and can provide a discounted rate.